AI-Based Document Verification: The Future of KYC & Aadhaar Authentication

Introduction

In today’s digital world, identity verification is essential for financial transactions, online registrations, and secure access to services. AI-based document verification is revolutionizing KYC (Know Your Customer) and Aadhaar authentication, making the process faster, more accurate, and fraud-resistant.

With the rise of AI-driven facial recognition, OCR (Optical Character Recognition), and biometric verification, businesses and government agencies are automating identity checks, reducing paperwork, and enhancing security. But how does AI improve document verification, and what does the future hold for AI-powered KYC and Aadhaar authentication?

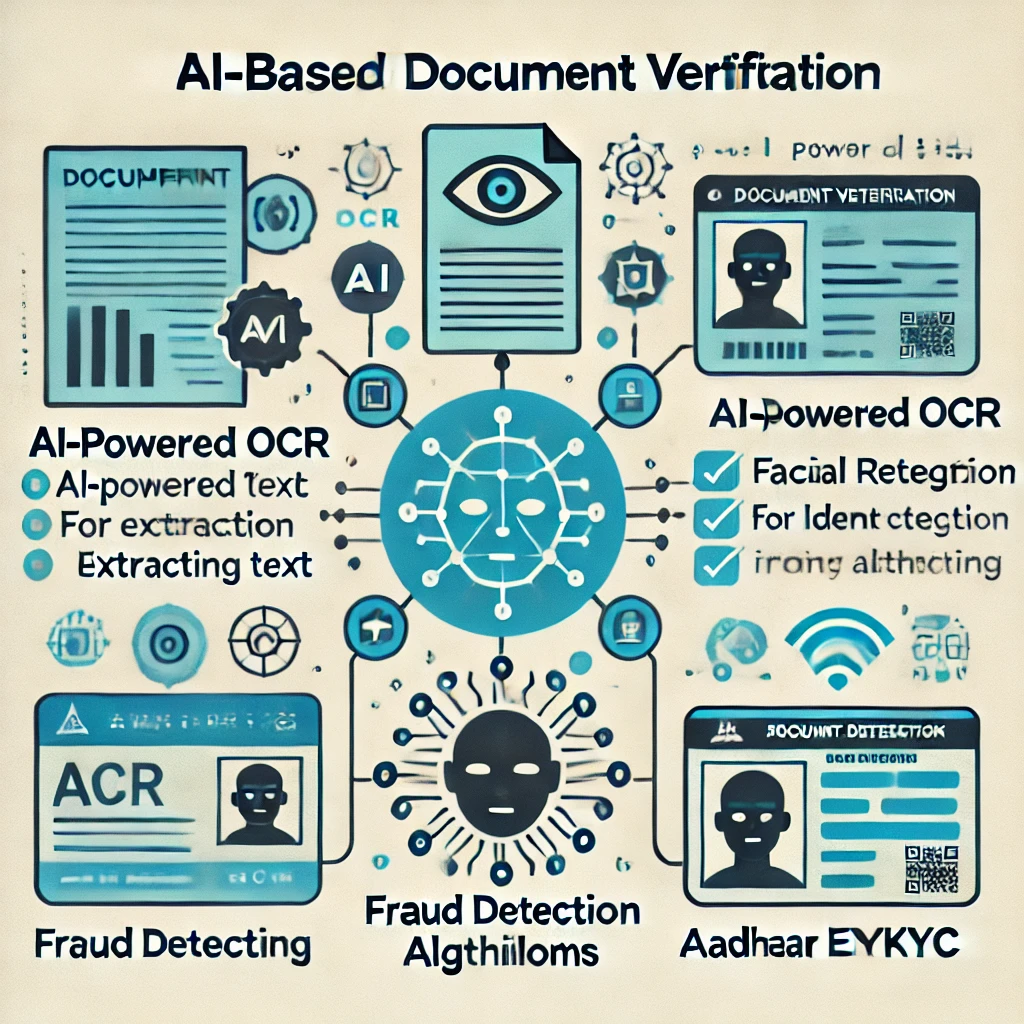

What is AI-Based Document Verification?

AI-powered document verification uses machine learning (ML), deep learning, and computer vision to authenticate identity documents such as Aadhaar cards, passports, driver’s licenses, and bank documents.

How It Works:

1️⃣ OCR (Optical Character Recognition) – Extracts text from scanned documents.

2️⃣ AI-Powered Data Validation – Cross-checks information with government databases.

3️⃣ Facial Recognition & Liveness Detection – Matches the user’s selfie with document photos.

4️⃣ AI-Based Fraud Detection – Identifies tampered or fake documents.

🚀 Example: AI-based KYC solutions like Onfido, HyperVerge, and Signzy use these techniques to automate identity verification.

AI in KYC & Aadhaar Authentication

KYC verification is mandatory for banking, fintech, telecom, and financial services. AI-powered solutions streamline the process by:

1. Automating Identity Verification

✅ Reduces manual errors in Aadhaar authentication.

✅ Speeds up bank account opening & loan processing.

✅ Ensures compliance with RBI & regulatory norms.

🚀 Example: Banks like HDFC, ICICI, and SBI use AI-driven Aadhaar eKYC to onboard customers within minutes.

2. Detecting Fraud & Identity Theft

✅ AI detects forged Aadhaar cards & fake documents.

✅ Uses pattern recognition & anomaly detection to flag suspicious activity.

✅ Prevents money laundering & financial fraud.

🚀 Example: AI tools like Jumio and AU10TIX use deep learning to verify document authenticity.

3. Enhancing Aadhaar-Based eKYC & eSign

✅ AI enables instant Aadhaar OTP verification.

✅ Supports paperless digital signatures (eSign) for agreements.

✅ Reduces paperwork and boosts remote onboarding.

🚀 Example: UIDAI’s Aadhaar eKYC API integrates AI-powered identity verification for telecom and banking sectors.

Benefits of AI-Based Document Verification

✅ Speed & Efficiency

AI reduces KYC verification time from days to minutes.

✅ Improved Accuracy

AI eliminates human errors, improving data reliability.

✅ Fraud Prevention

AI detects forged Aadhaar cards, duplicate PANs, and altered documents.

✅ Remote Verification & Paperless KYC

AI allows contactless onboarding for banks, fintech, and government services.

Challenges & Risks

❌ Privacy & Data Security Concerns

🚫 Risk of data leaks in AI-based Aadhaar verification.

❌ Bias in AI Algorithms

🚫 AI models may misidentify users if not trained on diverse data.

❌ Regulatory & Compliance Issues

🚫 Governments must ensure AI meets data protection laws (e.g., India’s DPDP Act).

The Future of AI in Document Verification

✅ AI-Driven Aadhaar Authentication with Blockchain – Secure identity verification.

✅ Face Recognition AI for eKYC – Eliminates the need for physical documents.

✅ AI-Powered Fraud Detection Systems – Enhances banking security.

✅ Decentralized Identity Management – Users control their Aadhaar & KYC data.

🚀 Example: The Indian government is exploring AI & blockchain for Aadhaar verification in banking & public services.

Conclusion: The Future of AI-Based KYC

AI-powered document verification is transforming Aadhaar authentication, KYC, and digital onboarding. While AI enhances security, speed, and fraud prevention, ethical concerns around data privacy and bias must be addressed.